haven t filed state taxes in 5 years

Take Advantage of Fresh Start Program. Get Your Free Consultation.

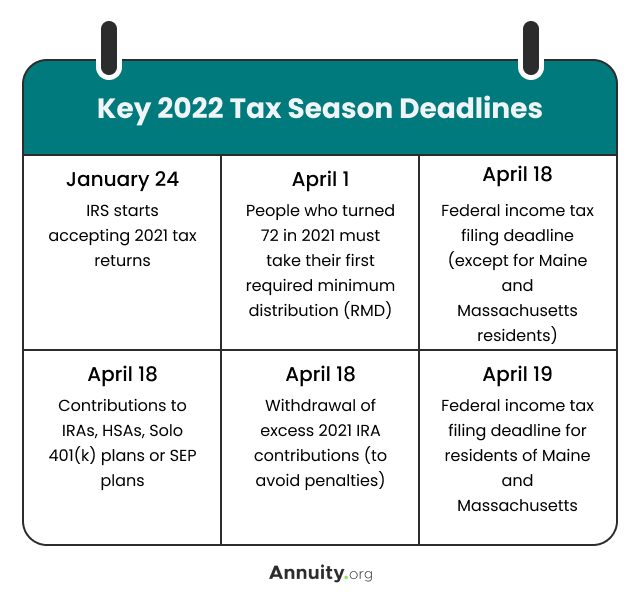

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

I have not filed my taxes since 2018 for 2017.

. Ad Quickly End IRS State Tax Problems. Ad Use our tax forgiveness calculator to estimate potential relief available. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less.

I havent filed taxes because I havent been working except random cash paying gigs here and there. Free Evaluation Apply Now. Incometax2020 Itr Income Tax Tax Refund Income Tax Return.

I have not filed my taxes since 2018for 2017. That said youll want to contact them as soon as. These Tax Relief Companies Can Help.

Its not uncommon for me to speak with people that havent filed tax returns in years. Its too late to claim your refund for returns due more than three years ago. I would appreciate any help im pretty clueless on.

Ad See if You Qualify For Tax Payer Relief Program. In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least 10000 in back taxes. Its too late to claim your refund for returns due more than three years ago.

See if youre getting refunds. These Tax Relief Companies Can Help. Then you have to prove to the IRS that you dont have the.

Havent Filed Taxes in 5 Years If You Are Due a Refund. Why sign in to the Community. However you can still claim your refund for any returns.

Ad Forgot to File Your Taxes. Contact the CRA. 0 Fed 1799 State.

Sign in to the Community or Sign in to TurboTax and start working on your taxes. 465 15 votes Failure to file or failure to pay tax could also be a crime. The IRS recognizes several crimes related to evading the assessment and payment of taxes.

Get Your Qualification Options for Free. Ad Quickly Prepare and File Your Prior Year Tax Return. Helping Taxpayers Since 2007.

Ad File Settle Back Taxes. If you need to catch up on filing taxes our software can help. I assume the last federal return you filed was for tax year 2008 and you have not filed for 2009 - 2013.

I recommend you visit your local Taxpayer Assistance Center TAC. Ad See the Top Rankings for Tax Help Companies That Fix IRS and State Tax Problems. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them.

If youre required to file a tax return and you dont file you will have committed a crime. Where do i even start. If you havent heard from the IRS in years dont fool yourself to think that they forgot about you and those missing personal or business returns and any past due tax.

Created By Former Tax Firm Owners Based on Factors They Know are Important. Im still a resident of California but havent technically lived there in 5 years. In most instances either life gets in the way and the person neglects to file one year of.

Ad Forgot to File Your Taxes. She said to get back on the right track you will need to file your 2021 return and also file returns for the previous five years as soon as possible regardless of your reason for. Possibly Settle Taxes up to 95 Less.

Answer 1 of 4. Free Evaluation Apply Now. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

Compare 2022s Best Tax Relief Companies to Help With IRS Back Taxes. If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing the. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available on the IRSgov Forms and Publications page or by calling toll-free 800.

Compare 2022s Best Tax Relief Companies to Help With IRS Back Taxes. If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign. 100s of Top Rated Local Professionals Waiting to Help You Today.

Complimentary Tax Analysis With No Obligation. After May 17th you will lose the 2018. Trusted A BBB Member.

0 Federal 1799 State. Havent Filed Taxes in 5 Years If You Are Due a Refund.

Haven T Filed Taxes In Years What You Should Do Youtube

Do I Have To File State Taxes H R Block

How To File Taxes For Free In 2022 Money

How To File Taxes Cashnetusa Blog Filing Taxes Tax Help Tax

I Haven T Filed Taxes In 5 Years Youtube

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

How To File Back Taxes On F J M Q Visas Filing Prior Year Tax Returns

F709 Generic3 Worksheet Template Printable Worksheets Profit And Loss Statement

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays

What To Do If You Haven T Filed Taxes In 10 Years Debt Ca

Missed The 2022 Us Tax Deadline Filing A Late Nra Tax Return

2022 Filing Taxes Guide Everything You Need To Know

There S Free And Then There S Me As Your Tax Preparer I Promise To Offer A True Concierge Tax Experience I Make I Tax Money Tax Preparation Turbotax

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

What If I Did Not File My State Taxes Turbotax Tax Tips Videos

Returns Filed Taxes Collected And Refunds Issued Internal Revenue Service

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

File Taxes Online E File Federal And State Returns 1040 Com Filing Taxes Online Taxes Finance Blog